Might four, 2021 — Formation Fi, a startup aiming to revolutionize defi portfolio building, has accomplished $three.three million in a strategic sale spherical.

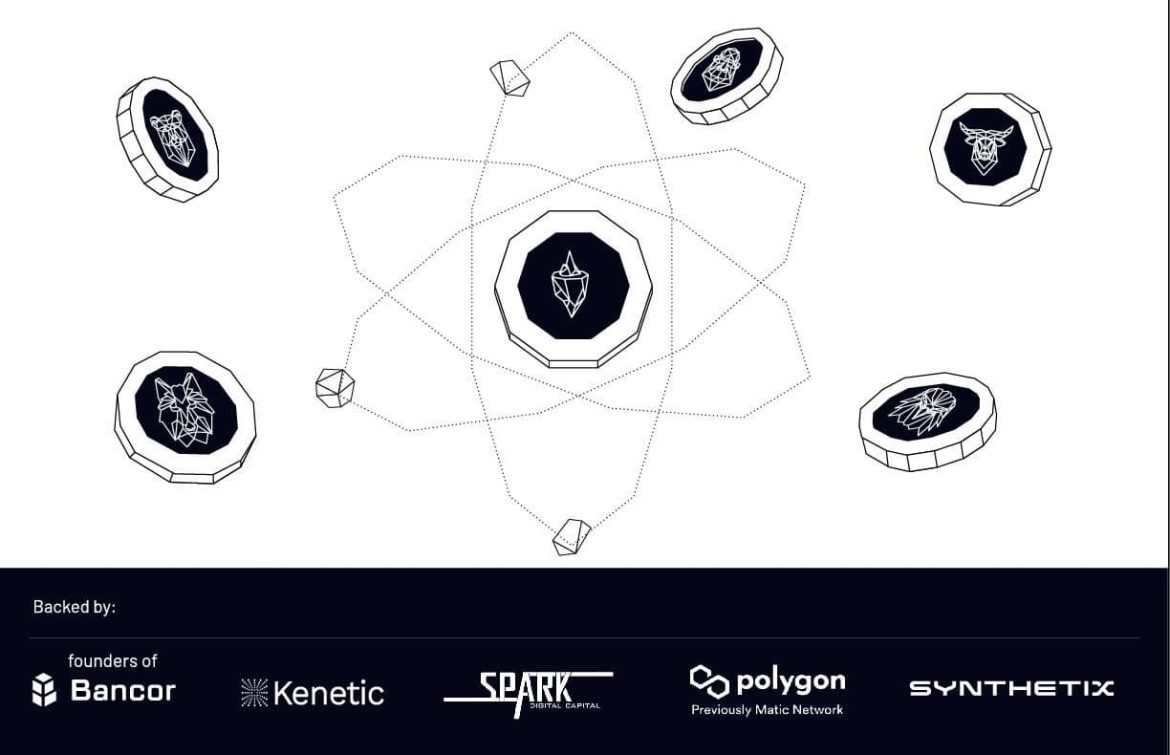

The platform garnered participation by the founders of ground-breaking DeFi protocols similar to Bancor, Synthetix, and Polygon (previously generally known as Matic), collectively managing over $6B in TVL, in addition to enterprise capital funds together with Kenetic, Kosmos, Spark Digital Capital, AU21, X21 Digital, Momentum 6, GenBlock, GBV Capital, Shima Capital, and Brilliance ventures.

An extra 18 top-tier buyers additionally contributed to the utterly oversubscribed spherical, with capital earmarked for the event of Formation Fi’s danger parity protocol, the primary chain-agnostic, algorithmic yield-management platform guided by the rules of the chance parity motion adopted by prime hedge funds on Wall Road.

Formation Fi has dubbed the idea Good Farming 2.zero, and envisions it as an development to defi’s present obsession with speculative yield chasing with out a lot regard for danger.

With danger parity impressed sensible yield farming 2.zero, customers get to tailor their stage of publicity whereas receiving steerage from the protocol which is engineered to scale back dangers posed by each bull and bear cycles.

Uniquely, Formation Fi is in search of to create a founders’ membership by attracting assist from solely the founders of prime DeFi firms it needs to work with long-term. Formation Fi ranges up yield farming portfolio building by facilitating higher administration thereof by way of a risk-adjusted portfolio of crosschain DeFi property.

Formation’s Co Founder Kristof Gagacki : “We’re proud to be constructing on the collective knowledge of a few of DeFi’s first pioneers. With our founders’ membership strategy, we’re centered on coming collectively to construct and amplify this still-experimental ecosystem and evangelize Good Yield Farming into the world of open finance”

By optimizing the return-to-risk ratio for every unit of danger, and prioritizing secular diversification based mostly on data-driven insights, Formation Fi guarantees to ship superior returns over time. The platform additionally goals to simplify the defi world in order that odd buyers can take part and earn yield over the lengthy haul.

The Formation Fi platform has been developed for a various consumer base. To get began, customers want solely deposit their most popular cryptocurrency and choose a most popular funding model, within the type of an index coin similar to Alpha, Beta, Gamma, and Parity. Every index coin can then be additional deployed for added yield on the holder’s discretion. Thereafter, the protocol will start producing yield with customers having access to the best-performing cross-chain yield methods based on their acknowledged danger tolerance.

Formation Fi has developed its personal native token which could be deployed in yield farming methods or added to a liquidity pool to spice up yield. A triple-utility token, $FORM entitles holders to voting rights, a share of future web revenue generated by the protocol, and grants unique entry to Formation Fi’s Darkpool AMM swimming pools.

About Formation Fi

Formation Fi is bringing cross-chain danger parity sensible farming to the world of decentralized finance. An evolution of conventional yield farming, the startup reconfigures defi portfolio building to assist customers higher handle danger and earn better returns.

Study extra: https://formation.fi/